Starting on the journey of investing in the stock market is an adventure that is both exhilarating and demanding. It is necessary to have a solid understanding of investment strategies to navigate this financial landscape successfully. The purpose of this comprehensive guide is to demystify exchange-traded fund (ETF) trading, provide stock market tips and tricks, explore inventive long-term plans, and eventually revolutionize your approach with cutting-edge methodology. We will uncover the crucial strategies for creating your route to riches.

Crafting Your Path to Wealth: Essential Investment Strategies Unveiled

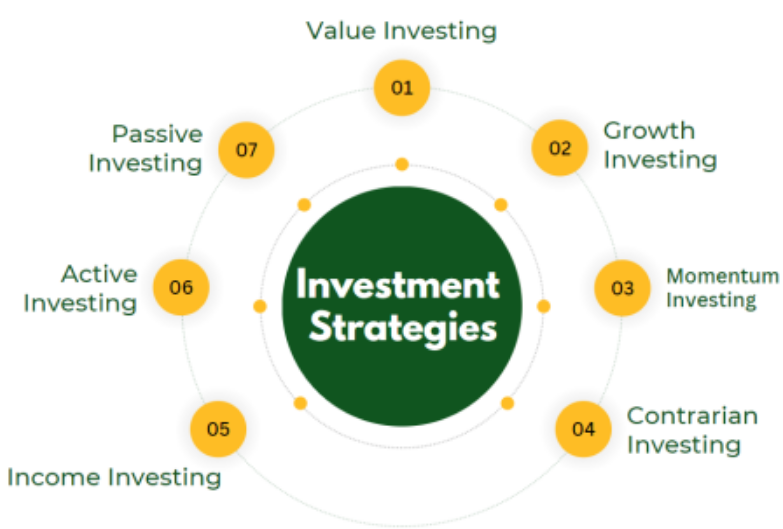

Success in the stock market can be achieved through the use of investment techniques. To become an expert at this game, you will need to employ a variety of strategies. Diversification allows you to safeguard your portfolio from the effects of market swings by spreading risk across different asset types. When you diversify your investments, you can achieve both stability and growth. This can be accomplished by including stocks, bonds, and other assets. To ensure that you continue to make progress toward your financial goals, you should rebalance your portfolio regularly.

Another method that has been tried and tested is called dollar cost averaging. Determine a predetermined amount to invest consistently, regardless of the state of the market. The impact of market swings is reduced by using this technique, which enables you to purchase a greater number of shares when prices are low and a smaller number of shares when prices are high.

There is a possibility that combining growth and value investing may help your portfolio perform even better. The potential gains on growth stocks are enormous, whereas the dividends and stability that value stocks offer are very important. The ability to strike the appropriate balance is a complementary component of an all-encompassing investment strategy, which increases the likelihood of your long-term success.

ETF Investing Demystified: Strategies to Supercharge Your Portfolio

The climate for investing has been revolutionized by exchange-traded funds, sometimes known as ETFs. The funds in question, which are made up of a collection of assets, provide both diversification and liquidity. You should think about sector-specific exchange-traded funds (ETFs) for targeted exposure, broad-market ETFs for overall market performance, and smart-beta ETFs for factor-based investing if you want to increase the size of your portfolio using ETFs.

When choosing an exchange-traded fund (ETF), it is essential to have a solid understanding of the underlying index. The makeup of the index, its methodology, and its historical performance should all be researched to guarantee that your investment goals will be achieved. Choose exchange-traded funds (ETFs) that have low expense ratios if you want to optimize your gains.

If you want to improve the efficiency of your ETF strategy, you should think about using tactical asset allocation. Your allocation should be adjusted by the current market conditions, economic projections, and worldwide trends. Through regular evaluation and reallocation, you can ensure that your portfolio will continue to be resilient in the face of fluctuating market conditions.

Stock Market Tips and Tricks: A Playbook for Savvy Investors

To successfully navigate the stock market, one must have a playbook that is packed with insightful strategies and approaches. To get started, you need first to develop attainable goals and a clearly defined investment strategy. Before you dive in, you should make sure that you have a clear understanding of your financial goals, your time horizon, and your risk tolerance. Maintaining a current awareness of market trends and economic data will allow you to make well-informed decisions.

When it comes to the stock market, patience is a virtue. Stay focused on your long-term objectives and steer clear of making decisions based on your emotions. Keep a close eye on your portfolio and make adjustments regularly, but resist the urge to make hasty choices based on fluctuations in the market over a short period.

Management of risks is really important. You can protect your capital and limit the likelihood of incurring losses by utilizing stop-loss orders. Diversify not only between different asset classes but also within each of those classes. Because of this, the impact of investments that are not performing well on your entire portfolio is reduced.

Innovative Strategies for Long-Term Stock Market Success

Innovative strategies are required to achieve sustained success in the stock market. You might want to think about theme investing, which involves aligning your portfolio with emerging trends and professions. It is important to identify potentially disruptive technologies, societal events, and environmental changes that could have an impact on the future.

Another successful method for achieving long-term profitability is to invest in dividend growth investment opportunities. You should focus on companies that have a track record of consistently increasing their dividends. Reinvesting dividends can result in an increase in returns over time, which can lead to a snowball effect that leads to the building of wealth.

A quantitative method is utilized in factor investing. After you have determined particular variables such as value, momentum, or quality, you should then disperse your investments by those variables. This methodical approach optimizes the risk-adjusted returns of your portfolio and is in line with academic research on the peculiarities of the market.

Revolutionizing Your Approach: Cutting-Edge Investment Strategies

The use of innovative strategies has the potential to revolutionize your approach to finances. Information analysis and trend forecasting are two areas in which artificial intelligence and machine learning have the potential to be incredibly useful tools. Automating your financial decisions and taking advantage of market inefficiencies can be accomplished through the use of robo-advisors or algorithmic trading technologies.

ESG investing, which stands for environmental, social, and governance investing, involves including in your portfolio standards that are both ethical and sustainable. This socially responsible strategy not only coincides with your beliefs but also decreases the risks that are connected with firms that disrespect their responsibilities to the environment and society.

The traditional financial system is being disrupted by blockchain technology and cryptocurrency. Investing a small percentage of your portfolio in digital assets can provide you with diversification and exposure to this quickly growing sector, even though this type of investment is considered to be high-risk.

Conclusion:

When it comes to the fast-paced world of stock market investing, it is vital to acquire a range of strategies to achieve success. You can make your path with important investment ideas, increase the value of your portfolio with exchange-traded funds (ETFs), make use of sage advice and techniques, study innovative long-term methods, and revolutionize your approach with technologically advanced solutions. You will be able to navigate the complexities of the stock market and establish a foundation for long-term financial success if you put these professional strategies into action. Happy investing to you!